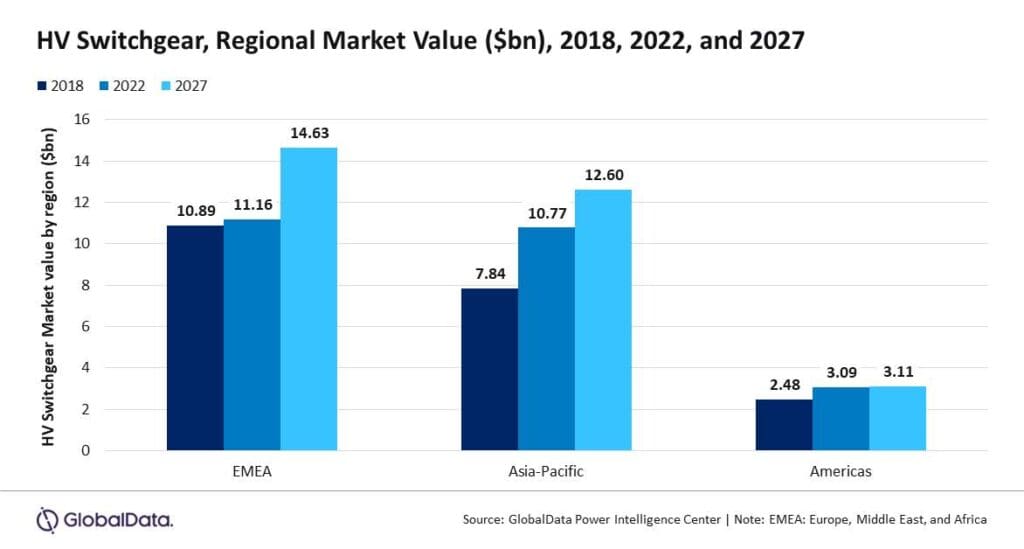

Fuelled by the increasing demand for electricity, new research forecasts the global high-voltage switchgear market to grow from $25.02 billion in 2022 to $30.34 billion by 2027.

This is according to findings from data and analytics company GlobalData, which projects a compound annual growth rate (CAGR) of 3.54% for the market from now to 2027.

According to the company’s report Switchgears for Power Transmission, Market Size, Share and Trends Analysis by Technology, Installed Capacity, Generation, Key Players and Forecast, 2022–2027, while the market has been seen growth across regions, market drivers are context-specific.

For example, states the report, within the growing economies of the Asia-Pacific and Middle East (EMEA) regions, the market’s growth is being propelled by the increasing demand for electricity, with capacity addition in the generation and transmission sectors.

On the other hand, in the Americas and Europe, the report finds the replacement of ageing grid infrastructure, the shift to renewable energy, grid reliability issues, improved policy and investment decisions, as well as technology innovations as key factors.

Have you read:

Liechtenstein to convert MV switchgear to Clean Air

ABB opens climatic test chamber for energised MV switchgear

London Power Tunnels substation to be SF6-free

EMEA

Overall, states GlobalData, the EMEA region was found to be the leader in the market in 2022, with a share of 44.60% and a forecast to grow to 48.24% by 2027, higher than the growth expected in all other regions.

According to GlobalData, the high voltage (HV) switchgear market in the EMEA region was estimated to be $11.16 billion in 2022 and is projected to reach $14.63 billion, registering a CAGR of 5.03% over 2023-27.

An additional driver, states the research, was an observed economic boom for Middle Eastern countries, leading to an increased demand for power.

Commenting on the report’s findings was GlobalData senior power analyst Bhavana Sri Pullagura, who stated how “the growing demand for electricity is giving rise to the need for new power plants, particularly those modes of generation that have minimal impact on the environment.”

With this, stated Pullagura, countries have started looking towards eliminating barriers to deployment of renewable technologies and gas-based generation.

“The falling capital cost and low gas prices also resulted in increased development of renewables and gas power plants. This contributed to the growth of the switchgear market, which is expected to continue as countries seek to increase the share of renewables and gas in their generation mix.”

Asia-Pacific

According to the report, in 2022, Asia-Pacific’s market value stood at $10.77 billion, accounting for a share of 43.05% in the global HV switchgear market. The HV switchgear market in the Americas is expected to reach $3.11 billion by 2027, as the grid requires upgrades to replace aging assets and to accommodate the increasing sources of renewable energy.

China, one of the fastest-growing economies with the largest fleet of transmission substations, topped the report’s global HV switchgear market in 2022 with a value of $7.73 billion, accounting for a 30.0% share. The country is expected to continue its leadership during the forecast period, reaching $9.19 billion in 2027.

Read more:

Replacing F-gases in switchgear: a revolution in the making

SF6-free AirSeT MV innovation by Schneider Electric

Bhavana Sri added: “The need to build transmission infrastructure to deliver power from renewable sources in remote regions, the increasing domestic demand for electricity, large-scale renewable energy deployment, the projected growth in the gross domestic product and rural electrification initiatives are some of the major factors aiding the growth of its HV switchgear market in China.

“The country is the world leader in ultra-high-voltage transmission, having made considerable investments in the development of transmission systems of voltage level of 765kv and above.”

The other major countries in the Asia-Pacific gas-insulated switchgear market, states GlobalData’s research, include India and Japan. India ranks third after China and the US in the global HV switchgear market, with a value of $1.15 billion in 2022 and a share of 4.60%.

“GlobalData believes that policies established to address environmental challenges and capitalise on market opportunities offered by technologies would notably impact the switchgear market by the end of the forecast period,” states Bhavana Sri.